Income tax calculator for retired person

For a single person making between 9325 and 37950 its 15. Tax calculator Age UK no longer provides a tax calculator.

Personal Pension Schemes In Ghana Licensed Trustees Fund Managers Pensions Person Management

Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Covered us 112A 10.

. Military retirement pay all or part of pensions and annuities all or part of Individual Retirement Accounts IRA. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Reconcile Child Tax Credit Payments.

1040 Tax Calculator Updated May 2022 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Go to HMRC tax calculator Its. These are long-term assets but withdrawals arent taxed as long-term capital gains.

Combined income includes your adjusted gross income nontaxable interest and half of your Social Security benefits. Estimate your tax refund with HR Blocks free income tax calculator. Instead we recommend you use the HMRC tax calculator to check youre being correctly taxed.

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income tax rates. Your 2021 Tax Return. Taxation of social welfare payments.

Based on your projected tax. It takes into account income. The calculator will calculate tax on your taxable income only.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Income tax credits and reliefs. The types of income which are taxable include but are not limited to. H and R.

In order to calculate the income tax for a senior citizen all the income is taken into consideration along with the allowable deductions and the income tax slab for FY 2020-21. Your household income location filing status and number of personal. This document is in.

Tax information for seniors and retirees including typical sources of income in retirement and special tax rules. Special taxation arrangements apply to people aged 65 and over. The good news is.

This calculator only provides you with an indication of the tax you may have to pay based on rates and allowances which apply to the 202223 tax year. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. The tool then automatically calculates the.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. For example if you file as an individual and your.

Corporate Tax Accountant Resume How To Draft A Corporate Tax Accountant Resume Download This Corporate Tax Accountan Accountant Resume Tax Accountant Resume

Tax

Accounting Cake Design

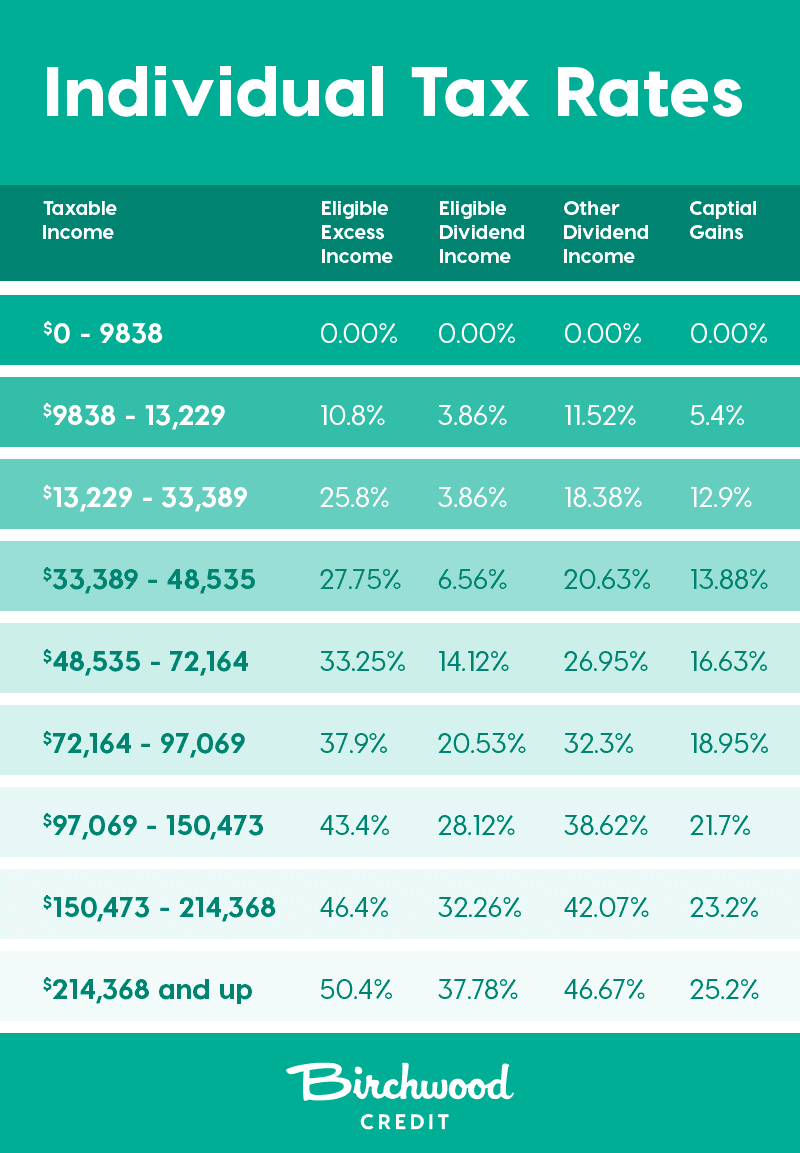

Personal Income Tax Brackets Ontario 2021 Md Tax

Pin By Ananya Sharma On Places Download Resume Tax Rules Inspirational Quotes

Retirement Cake For An Accountant Retirement Cakes Cake Cake Designs

2021 2022 Income Tax Calculator Canada Wowa Ca

Pin On Financial News Business Tips

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Designs Accountant Birthday Cake

Pin On Excel Project Management Templates For Business Tracking

Salary Slip Templates 20 Ms Word Excel Formats Samples Forms Payroll Template Cv Template Word Word Template

1

Planning For Retirement Using The Dave Ramsey Investment Calculator Dave Ramsey Investing Dave Ramsey Investing

How I Retired At Age 30 With 500 000 Saved Personal Finance Advice Early Retirement Budget Advice

Ontario Income Tax Calculator Wowa Ca

Rental Property Tax Deductions Worksheet Photograph Nice